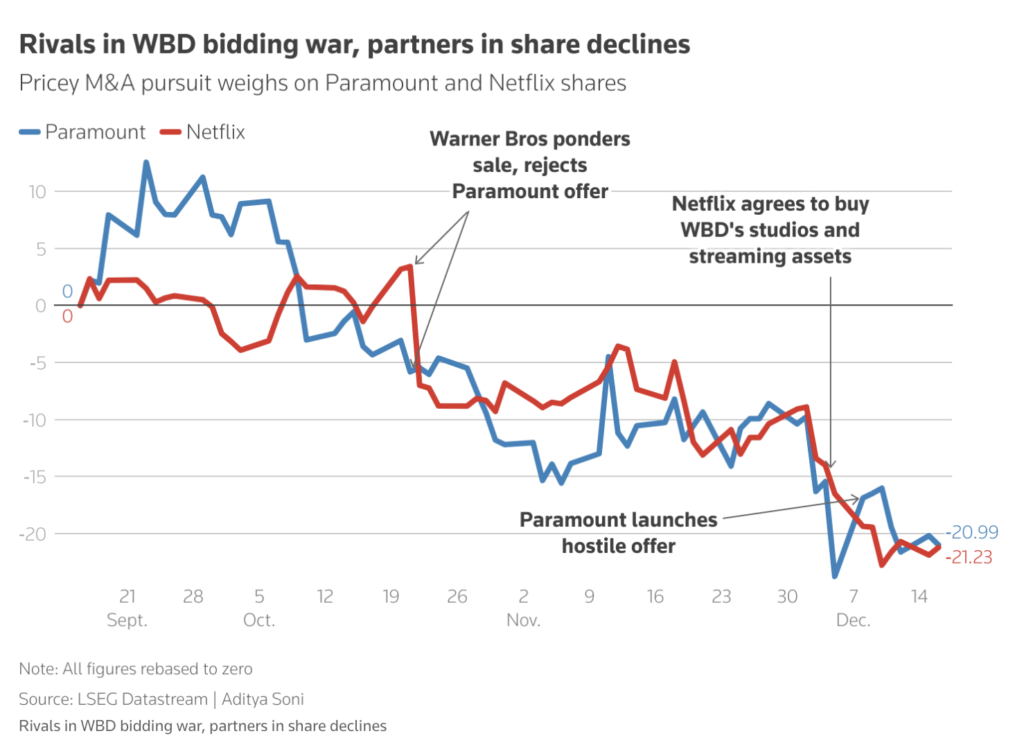

Warner Bros. Discovery board shuts down rival takeover bid from Paramount

Warner Bros. Discovery has rejected Paramount Skydance’s $108.4bn hostile takeover bid, branding the offer “illusory” and accusing Paramount of misleading shareholders about the strength of its financing.

In a strongly worded letter released on Wednesday, the WBD board said Paramount had repeatedly claimed its $30-per-share all-cash offer was fully guaranteed by the Ellison family, led by Oracle co-founder Larry Ellison. The board said that claim was false, warning the proposal carried “numerous, significant risks” and could be altered or withdrawn at any time.

The board said Paramount’s bid was inferior to Warner Bros Discovery’s existing merger agreement with Netflix, describing the streaming giant’s $27.75-per-share cash-and-stock deal as binding, fully financed and supported by robust debt commitments. Warner Bros added that Netflix’s offer requires no equity financing, unlike Paramount’s proposal.

Paramount pushed back, accusing Warner Bros of hiding behind a “cloud of obfuscation” and arguing its all-cash bid offers greater certainty than Netflix’s deal, which has been dented by a fall in Netflix’s share price. However, Warner Bros raised concerns about Paramount’s financial position, debt levels and credit rating, warning a combination would leave shareholders exposed to heavy leverage and restrictive operating conditions.

Shares reflected the uncertainty, with Warner Bros falling 1.2%, Paramount sliding 4.8% and Netflix gaining 2.5%, as the battle for control of the Hollywood studio intensifies ahead of a shareholder vote expected in the coming months.